- HP 10BII FINANCIAL CALCULATOR PRESENT VALUE HOW TO

- HP 10BII FINANCIAL CALCULATOR PRESENT VALUE MANUAL

- HP 10BII FINANCIAL CALCULATOR PRESENT VALUE FREE

This would be correct had you borrowed $100 today (cash inflow) and agreed to repay $161.05 (cash outflow) in five years.

Had you entered the $100 as a positive number no harm would have been done, but the answer would have been returned as a negative number. In this problem, the $100 was an investment (i.e., a cash outflow) and the future value of $161.05 would be a cash inflow in five years. Cash inflows are entered as positive numbers and cash outflows are entered as negative numbers. This is simply a way of keeping the direction of the cash flow straight.

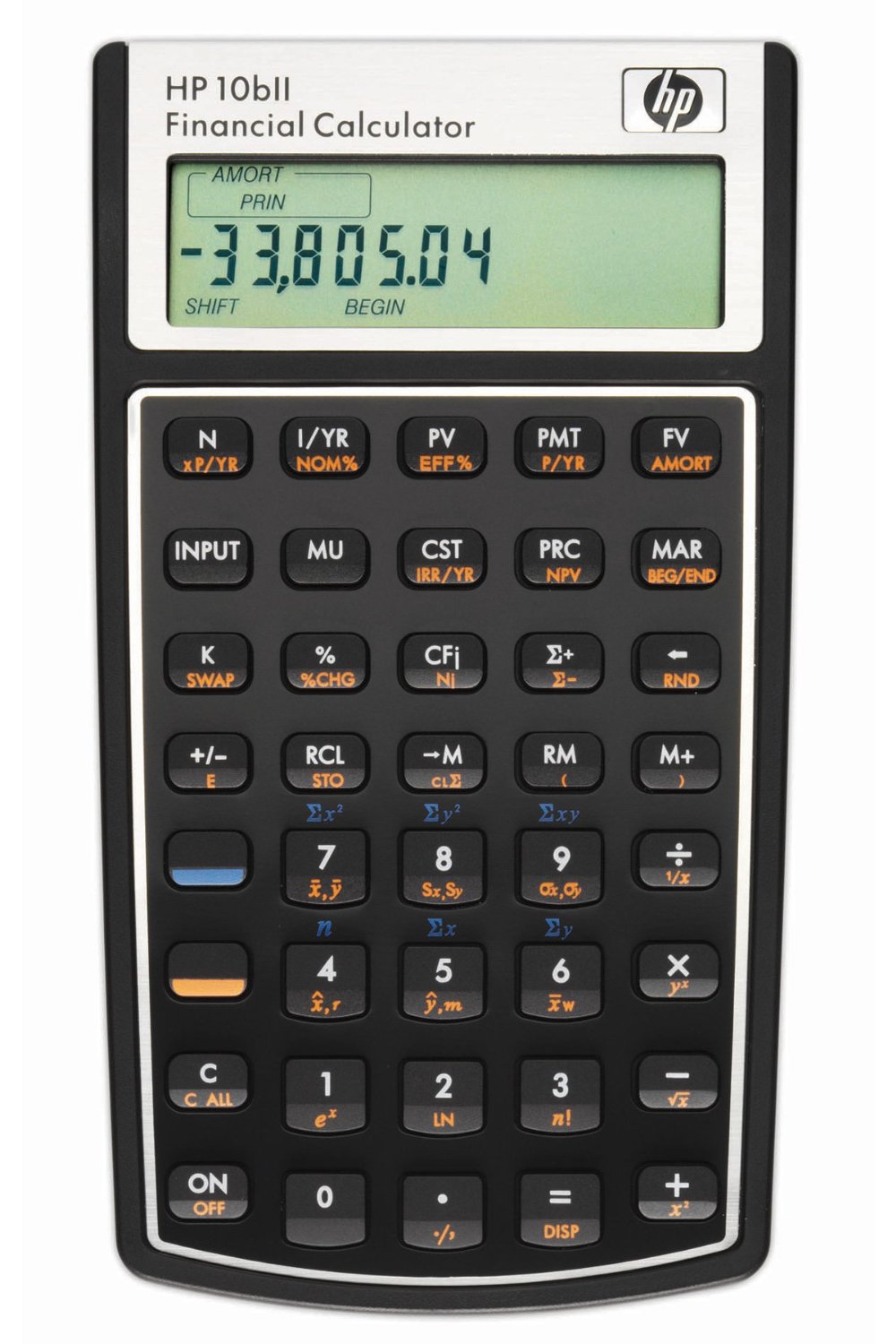

Most financial calculators (and spreadsheets) follow the Cash Flow Sign Convention. Notice that we entered the 100 in the PV key as a negative number.Had you entered 0.10, the future value would have come out to 100.501 - obviously incorrect. This is because the calculator automatically divides any number entered into I/YR by 100. When we entered the interest rate, we input 10 rather than 0.10.The order in which the numbers are entered does not matter.To solve these problems you simply enter the variables that you know in the appropriate keys and then press the other key to get the answer. In this case, we have a 4-variable problem and were given 3 of them (N, i, and PV) and had to solve for the 4th (FV). Of these, you will always be given 3 or 4 and asked to solve for the other. Every time value of money problem has either 4 or 5 variables.Now to find the future value simply press the FV key. Now all we need to do is enter the numbers into the appropriate keys: 5 into N, 10 into I/YR, -100 into PV. Otherwise, you may find that numbers left over from previous problems will interfere with the solution to this one. Before entering the data you need to make sure that the financial registers (each key is nothing more than a memory register) are clear. In this problem, the $100 is the present value (PV), N is 5, and i is 10%. How much will you have accumulated at the end of this time period? Suppose that you have $100 to invest for a period of 5 years at an interest rate of 10% per year. We'll begin with a very simple problem that will provide you with most of the skills to perform financial math on the 10BII: If it isn't there, please drop me a note and I'll try to answer the question. If you don't find the answer that you are looking for, please check the FAQ. That's it, the calculator is ready to go. I would press Shift = 5 to display 5 decimal places. To change the display, press Shift =, and finally the numeric key that corresponds to the number of digits you would like to see displayed. Personally, I like to see five decimal places, but you may prefer some other number. By default the 10BII displays only two decimal places. Now, just make sure that you always enter the total number of periods (not necessarily years) into N, the per period interest rate into I/YR, and the per period payment into PMT. To check that it has taken, press Shift and then C (clear all).

To fix this problem press 1 (once per year) then Shift and finally PMT. Of course, most people don't recognize a wrong answer when they get one, so they blithely forge ahead. Why? Well, the compounding assumption is hidden from view and in my experience people tend to forget to set it to the correct assumption.

HP 10BII FINANCIAL CALCULATOR PRESENT VALUE MANUAL

That's fine, I suppose, but its better to set it to assume annual compounding and then make manual adjustments when you enter numbers. The 10BII comes from the factory set to assume monthly compounding. Initial Setupīefore we get started, we need to correctly (in my view, anyway) set up the calculator. We will not need the purple shift key in this tutorial. Please note that in the following text the orange key is referred to as Shift because it is used to shift to the orange-colored function below the key that is pressed next. I will keep the examples rather elementary, but understanding the basics is all that is necessary to learn the calculator.

HP 10BII FINANCIAL CALCULATOR PRESENT VALUE HOW TO

This tutorial will demonstrate how to use the financial functions to handle time value of money problems and make financial math easy. The Hewlett Packard 10BII is a very easy to use financial calculator that will serve you well in all finance courses. These calculators differ slightly, so you may prefer the HP 10B tutorial. If the picture at right doesn't match your calculator, you may have an original HP 10B.

HP 10BII FINANCIAL CALCULATOR PRESENT VALUE FREE

Are you a student? Did you know that Amazon is offering 6 months of Amazon Prime - free two-day shipping, free movies, and other benefits - to students? Click here to learn more

0 kommentar(er)

0 kommentar(er)